24,149 +

Happy

Investors

13%

Investor

XIRR

51

No of

Branches

0.28%

NPA

Percentage

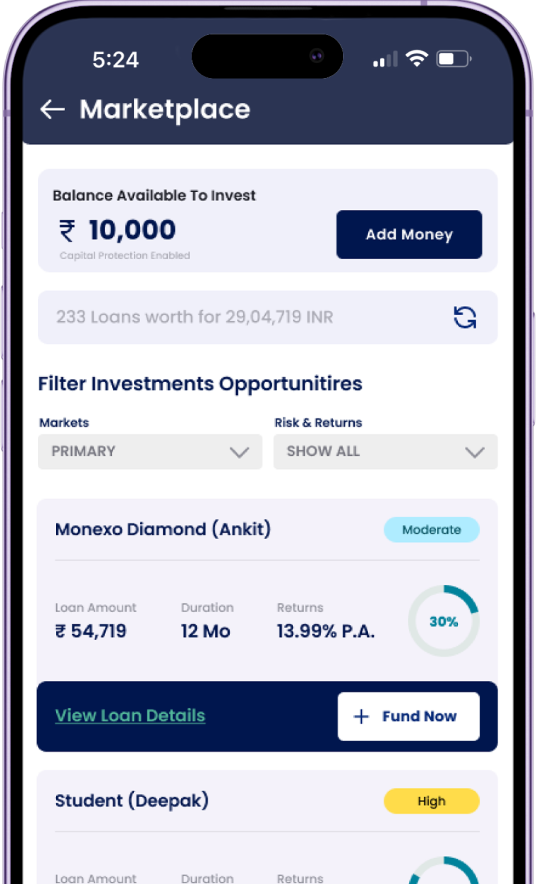

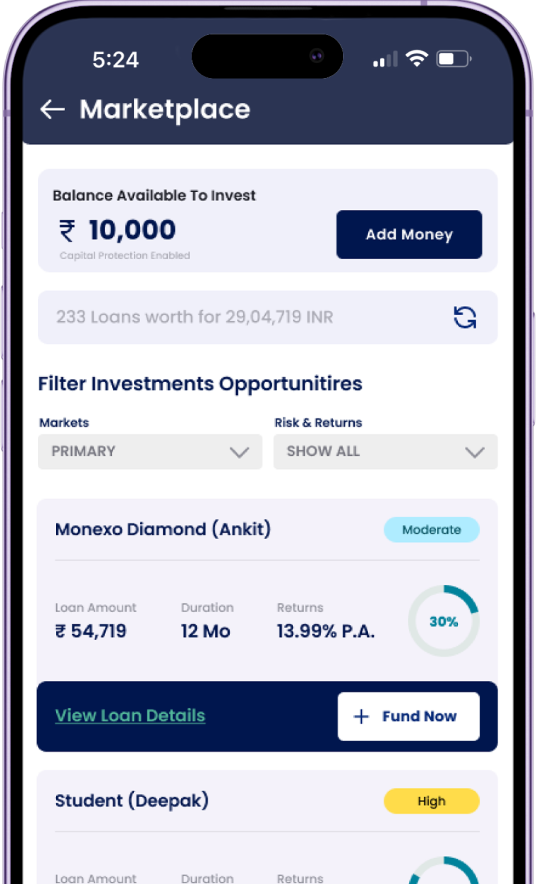

Monexo is the best RBI Licensed P2P lending platform where people borrow and lend money to each other in India. Monexo provides an alternative investment and financing model which is 100% online, simple and fast. Borrowers get personal loans at attractive interest rates and flexible terms. Investors get to diversify their investment portfolio in a new asset class and earn monthly passive income.

In a shared economy, Monexo is to finance like what Uber & Ola is to transport. An Alternative

Using our interactive investment calculator, see how your money can compound and grow with Monexo

If you put your money in many different places, you can earn more money and lower your chances of losing money. Be smart when you choose where to put your money, and make sure you are in charge of all your investments.

Investors can withdraw earnings at maturity, or even before.

Investment Amount

Tenure

% Interest Rate

Principal

Interest

Total Payable

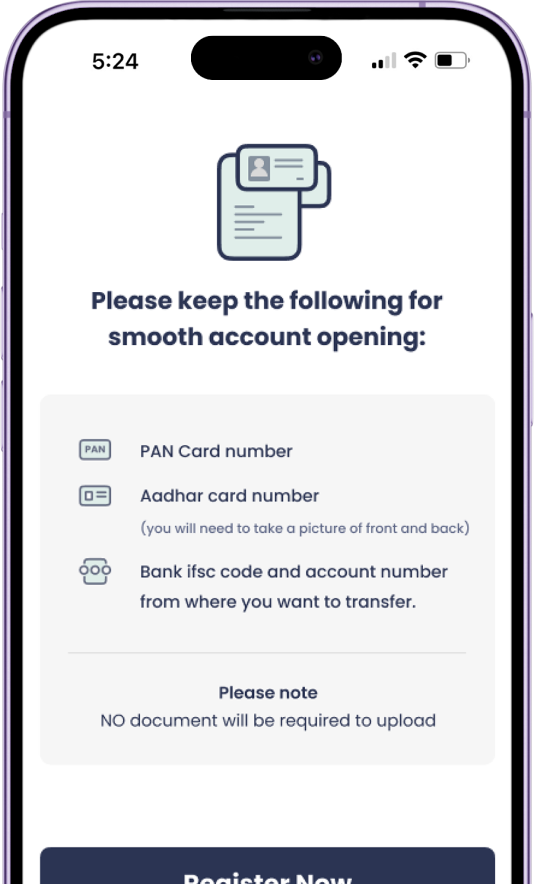

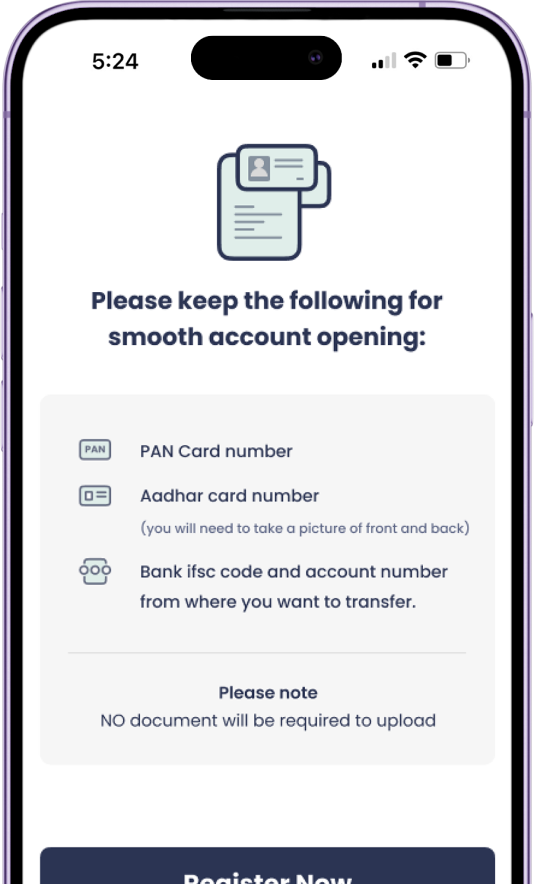

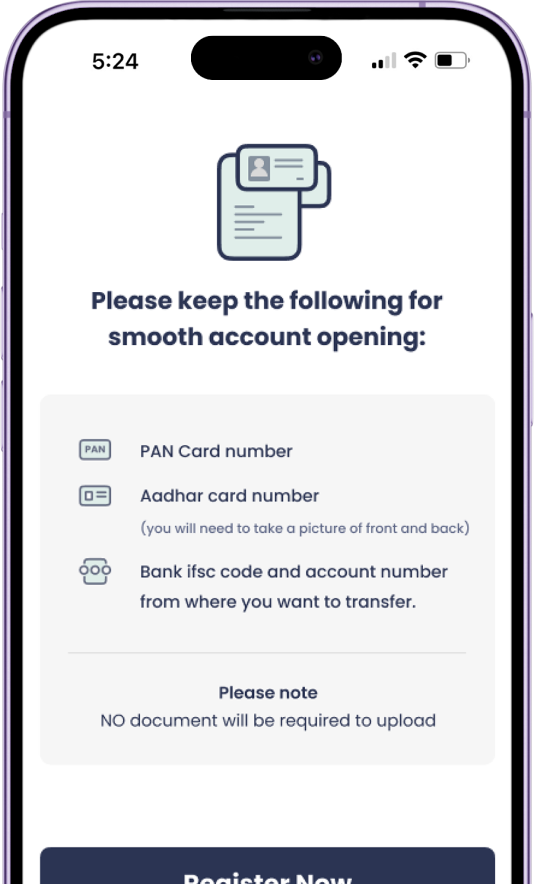

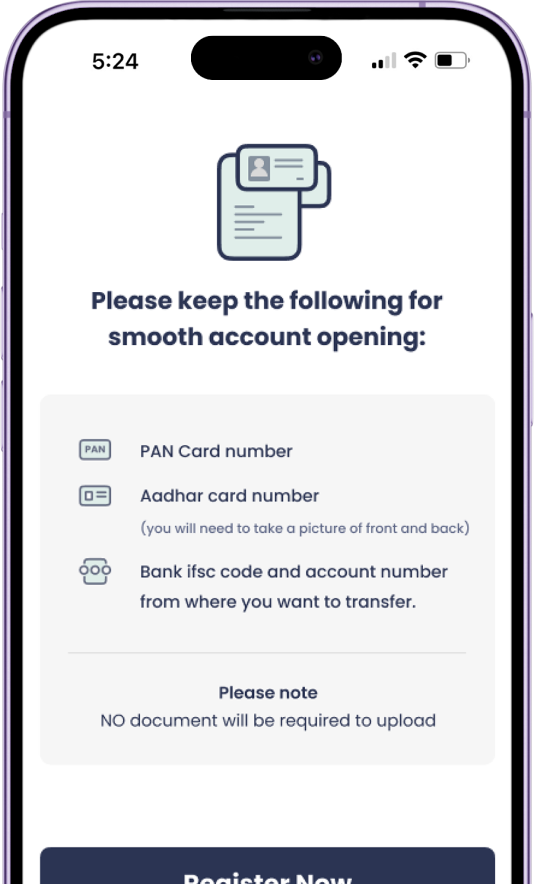

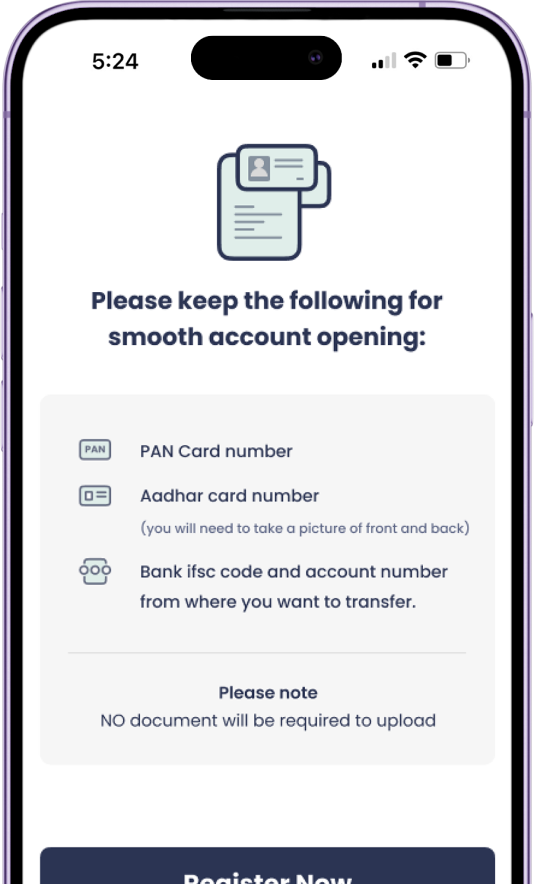

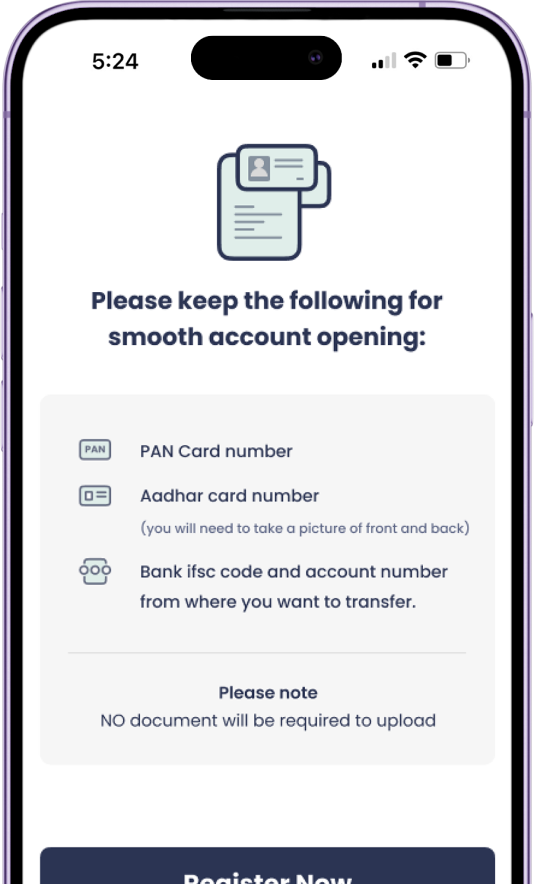

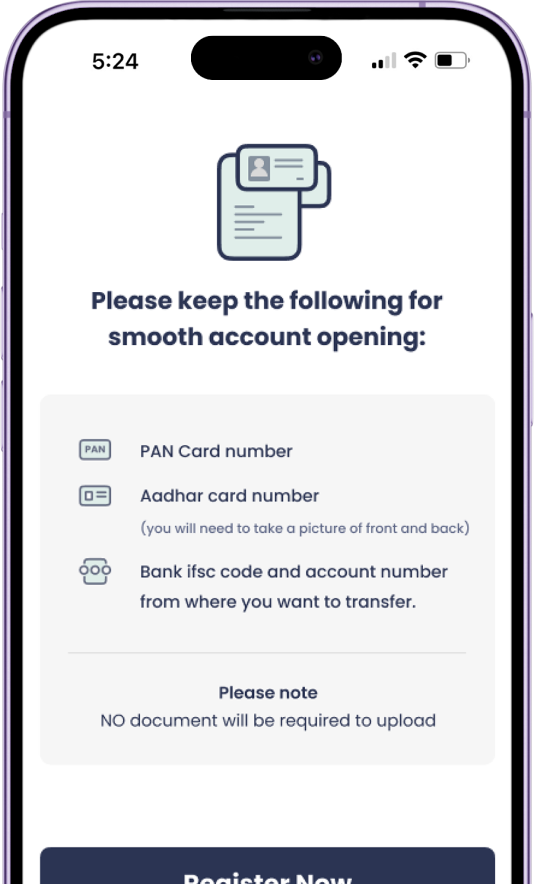

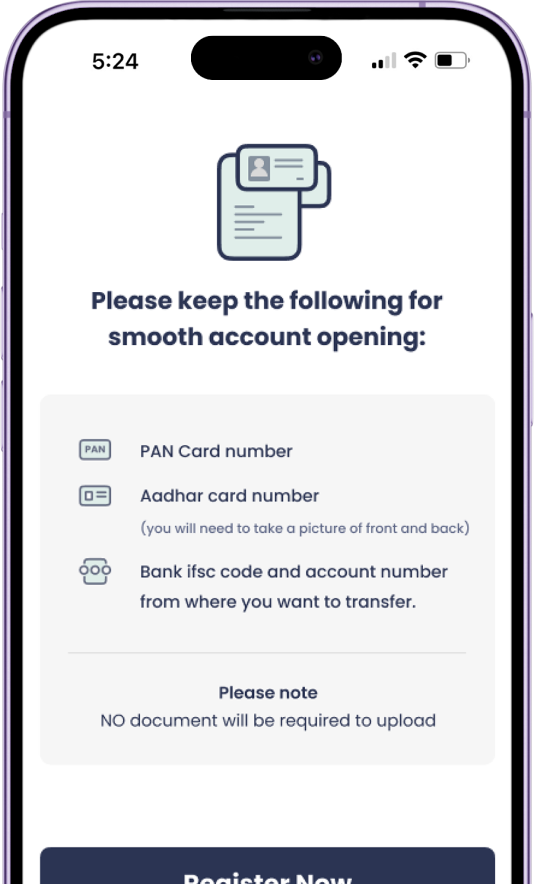

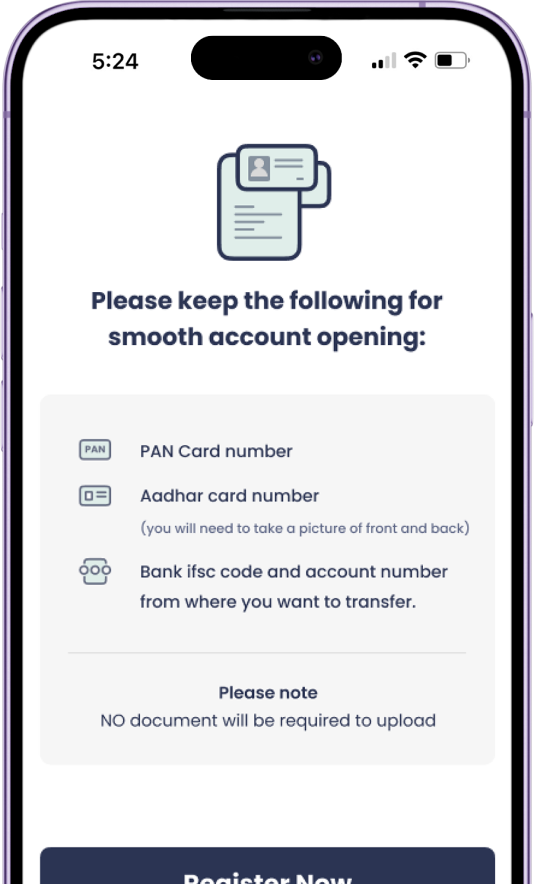

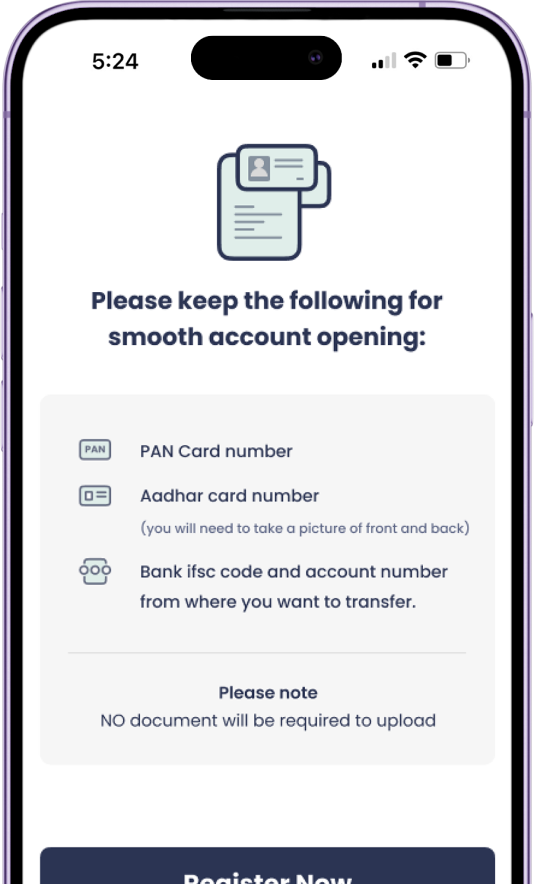

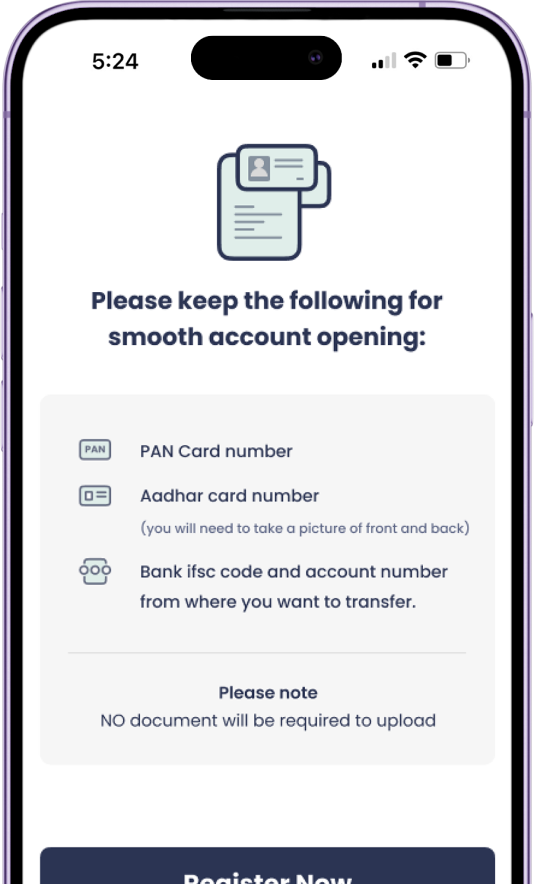

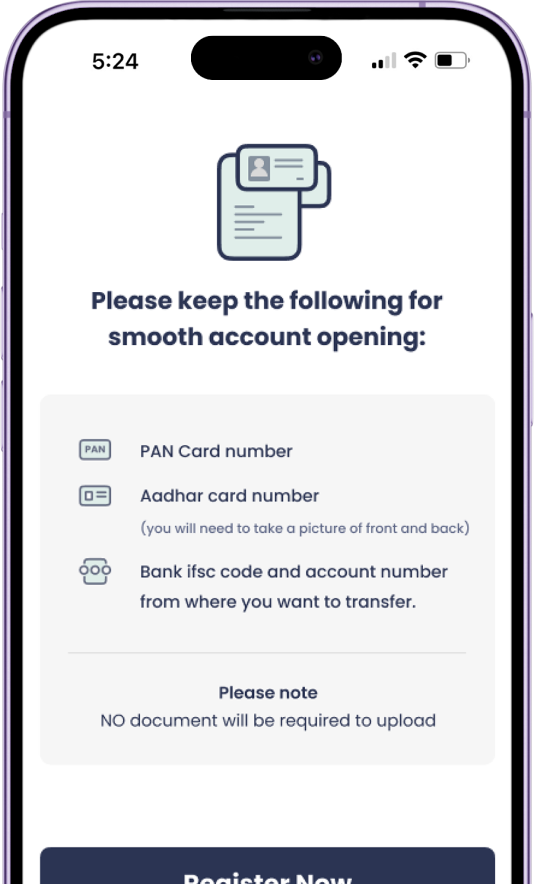

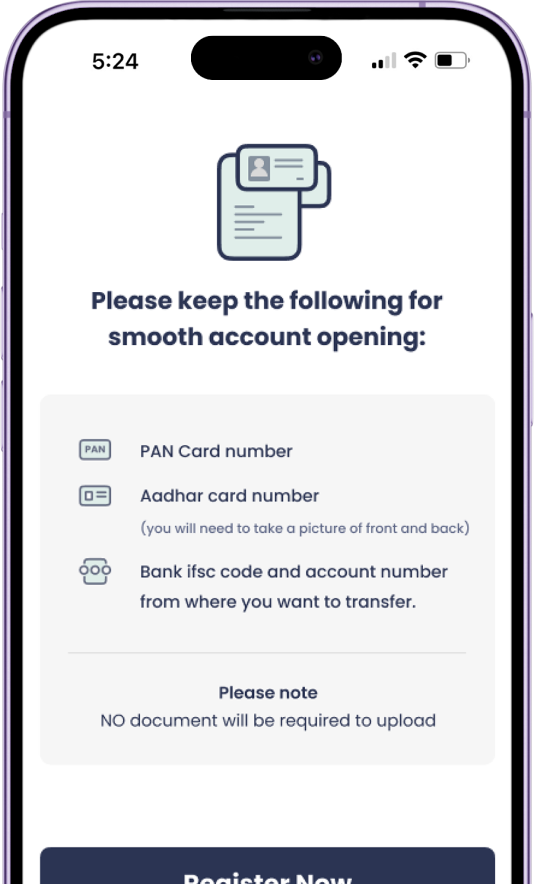

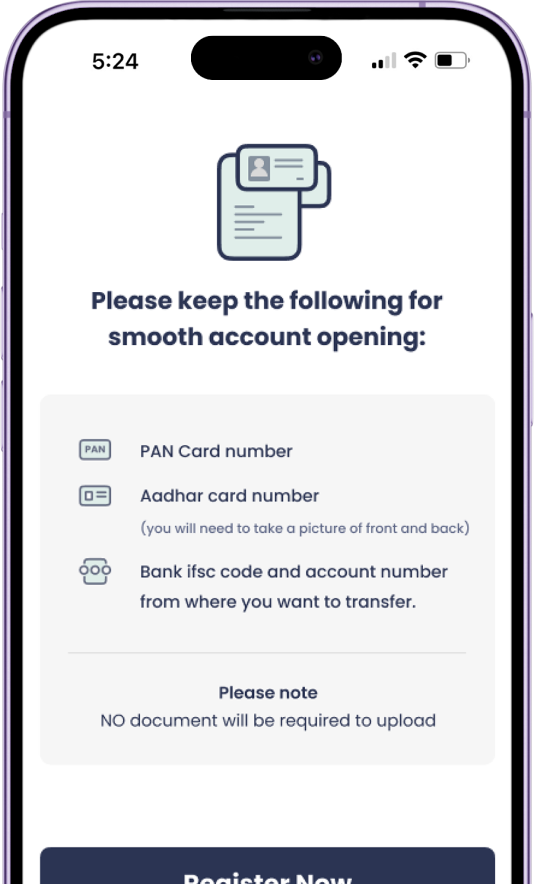

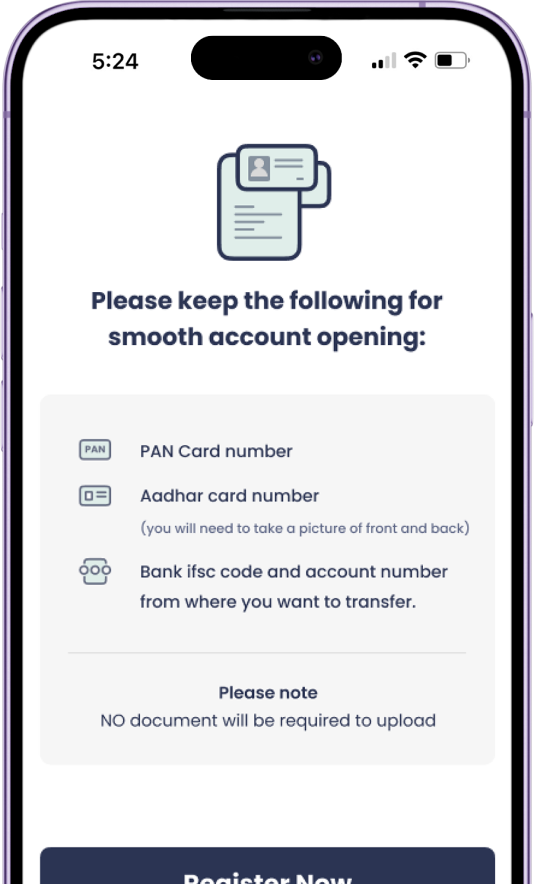

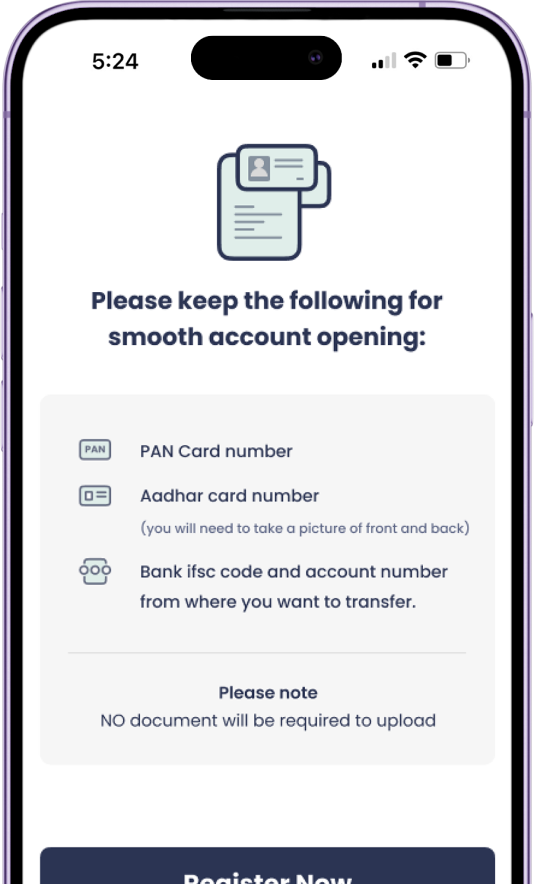

Step 1

Register

Create account online

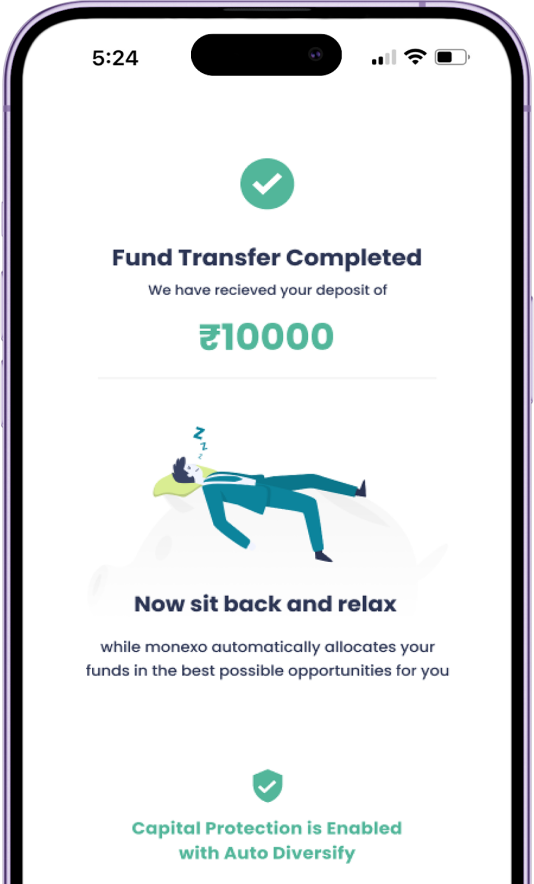

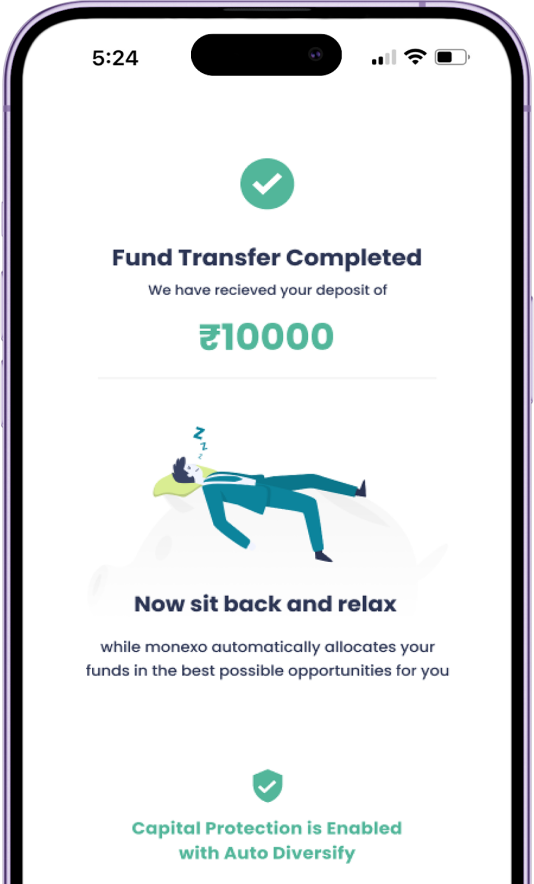

Step 2

Transfer Funds

Send money to third party Administrative Account.

Step 3

Select a loan

Choose from screened borrowers.

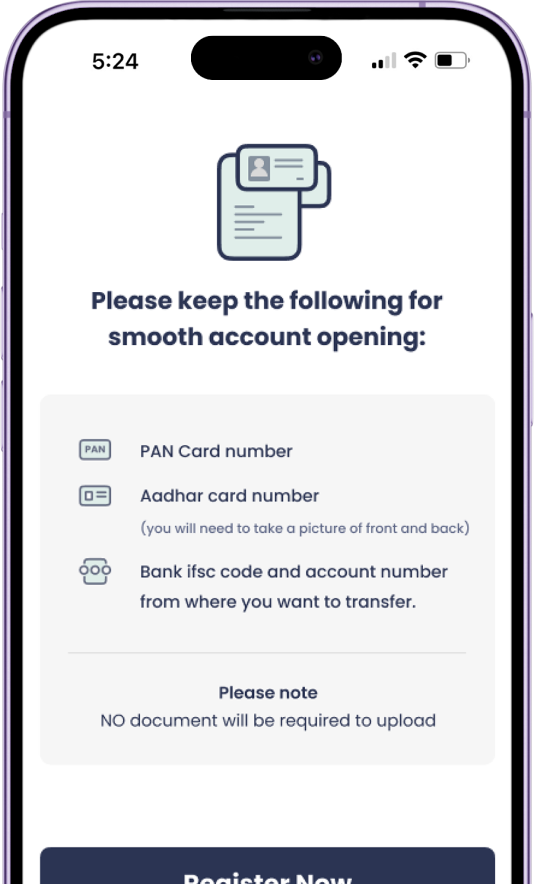

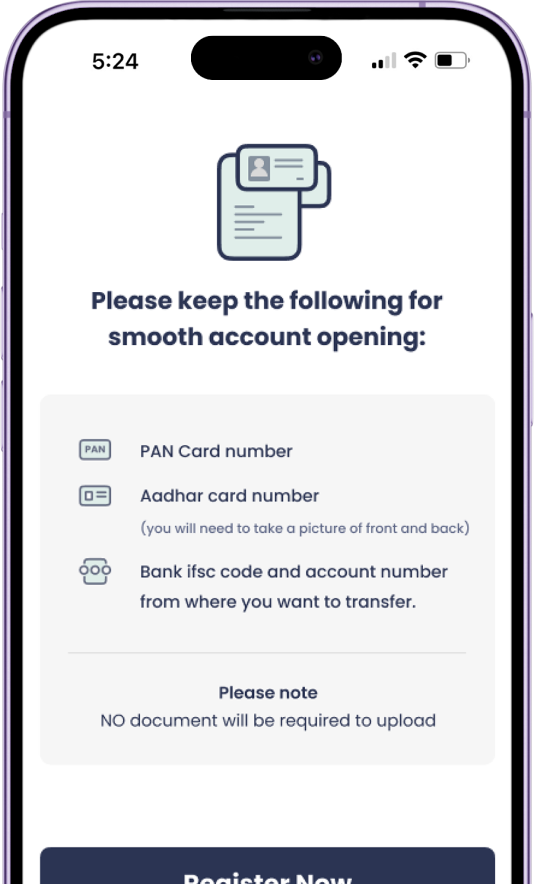

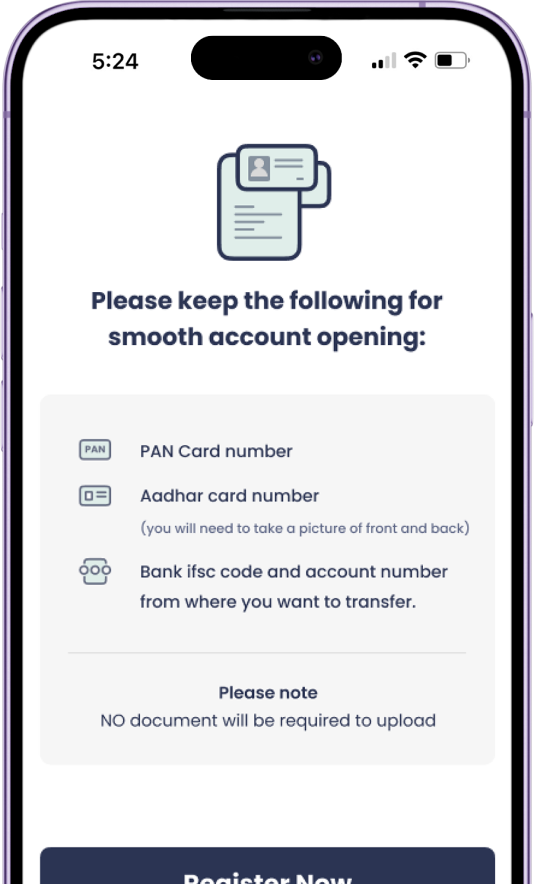

Step 1

Register

Create account online

Step 2

Transfer Funds

Send money to third party Administrative Account.

Step 3

Select a loan

Choose from screened borrowers.

Safe

and Secure

We will provide you with comprehensive information about each investment opportunity, including investment highlights, risks, terms, and potential earnings.

100%

Transparent

We prioritize investment safety, so we review every borrower's history and set appropriate interest rates accordingly.

Best

Interest Rates

Earn high returns on your investments with regular payments and interest rates of 13-20%. Build wealth and passive income.

Amit Bhise

Co Founder, PPC Corp

I really love how simple it is to invest via Monexo. It is truly a revolutionary P2P lending platform that has a clear understanding of the Indian context of borrowing and lending & risks related to that space. The team is really co-operative and they solve customer grievances on priority.

Rashmi Yadav

Co Founder, PPC Corp

Monexo is a great platform for people who want to invest their money in options other than FDs and the stock market. I really like how simple and transparent it is to invest via Monexo. Great job team!

Jeevan Goyal

Co Founder, PPC Corp

I found P2P lending at Monexo Grow is a great platform for people who want to invest a small amount and get good returns. The returns are much higher than FDs and the stock markets with way less volatility.

Ankit Roy

Co Founder, PPC Corp

There is a good site where people can give loans in a simple and transparent manner.it is an excellent platform for investors to get better returns on their money as compared to FDs and Stock market.

Rajiveer Pathak

Co Founder, PPC Corp

Investing with them was one of the best experiences, the staff members are very helpful and friendly, they provide you with the best option and take all precautions to ensure that your money is safe.

Rakshit Sarang

Co Founder, PPC Corp

For those looking for alternative investment options to FDs and the stock market, Monexo is a great platform. I really like how simple and transparent it is to invest via Monexo. Great job team!

Amit Bhise

Co Founder, PPC Corp

I really love how simple it is to invest via Monexo. It is truly a revolutionary P2P lending platform that has a clear understanding of the Indian context of borrowing and lending & risks related to that space. The team is really co-operative and they solve customer grievances on priority.

Rashmi Yadav

Co Founder, PPC Corp

Monexo is a great platform for people who want to invest their money in options other than FDs and the stock market. I really like how simple and transparent it is to invest via Monexo. Great job team!

Jeevan Goyal

Co Founder, PPC Corp

I found P2P lending at Monexo Grow is a great platform for people who want to invest a small amount and get good returns. The returns are much higher than FDs and the stock markets with way less volatility.

Ankit Roy

Co Founder, PPC Corp

There is a good site where people can give loans in a simple and transparent manner.it is an excellent platform for investors to get better returns on their money as compared to FDs and Stock market.

Rajiveer Pathak

Co Founder, PPC Corp

Investing with them was one of the best experiences, the staff members are very helpful and friendly, they provide you with the best option and take all precautions to ensure that your money is safe.

Rakshit Sarang

Co Founder, PPC Corp

For those looking for alternative investment options to FDs and the stock market, Monexo is a great platform. I really like how simple and transparent it is to invest via Monexo. Great job team!

Amit Bhise

Co Founder, PPC Corp

I really love how simple it is to invest via Monexo. It is truly a revolutionary P2P lending platform that has a clear understanding of the Indian context of borrowing and lending & risks related to that space. The team is really co-operative and they solve customer grievances on priority.

Rashmi Yadav

Co Founder, PPC Corp

Monexo is a great platform for people who want to invest their money in options other than FDs and the stock market. I really like how simple and transparent it is to invest via Monexo. Great job team!

Jeevan Goyal

Co Founder, PPC Corp

I found P2P lending at Monexo Grow is a great platform for people who want to invest a small amount and get good returns. The returns are much higher than FDs and the stock markets with way less volatility.

Ankit Roy

Co Founder, PPC Corp

There is a good site where people can give loans in a simple and transparent manner.it is an excellent platform for investors to get better returns on their money as compared to FDs and Stock market.

Rajiveer Pathak

Co Founder, PPC Corp

Investing with them was one of the best experiences, the staff members are very helpful and friendly, they provide you with the best option and take all precautions to ensure that your money is safe.

Rakshit Sarang

Co Founder, PPC Corp

For those looking for alternative investment options to FDs and the stock market, Monexo is a great platform. I really like how simple and transparent it is to invest via Monexo. Great job team!

Amit Bhise

Co Founder, PPC Corp

I really love how simple it is to invest via Monexo. It is truly a revolutionary P2P lending platform that has a clear understanding of the Indian context of borrowing and lending & risks related to that space. The team is really co-operative and they solve customer grievances on priority.

Rashmi Yadav

Co Founder, PPC Corp

Monexo is a great platform for people who want to invest their money in options other than FDs and the stock market. I really like how simple and transparent it is to invest via Monexo. Great job team!

Jeevan Goyal

Co Founder, PPC Corp

I found P2P lending at Monexo Grow is a great platform for people who want to invest a small amount and get good returns. The returns are much higher than FDs and the stock markets with way less volatility.

Ankit Roy

Co Founder, PPC Corp

There is a good site where people can give loans in a simple and transparent manner.it is an excellent platform for investors to get better returns on their money as compared to FDs and Stock market.

Rajiveer Pathak

Co Founder, PPC Corp

Investing with them was one of the best experiences, the staff members are very helpful and friendly, they provide you with the best option and take all precautions to ensure that your money is safe.

Rakshit Sarang

Co Founder, PPC Corp

For those looking for alternative investment options to FDs and the stock market, Monexo is a great platform. I really like how simple and transparent it is to invest via Monexo. Great job team!

Reserve Bank of India does not accept any responsibility for the correctness of any of the statements or representations made or opinions expressed by Monexo, and does not provide any assurance for repayment of the loans lent on it.

Monexo Fintech Private Limited (www.monexo.co) is having a valid certificate of registration (CoR), dated 28th June 2018, issued by Reserve Bank of India under Section 45 IA of the Reserve bank of India Act, 1934.

© Copyright Monexo. All rights reserved.